Financial Aid & Scholarships

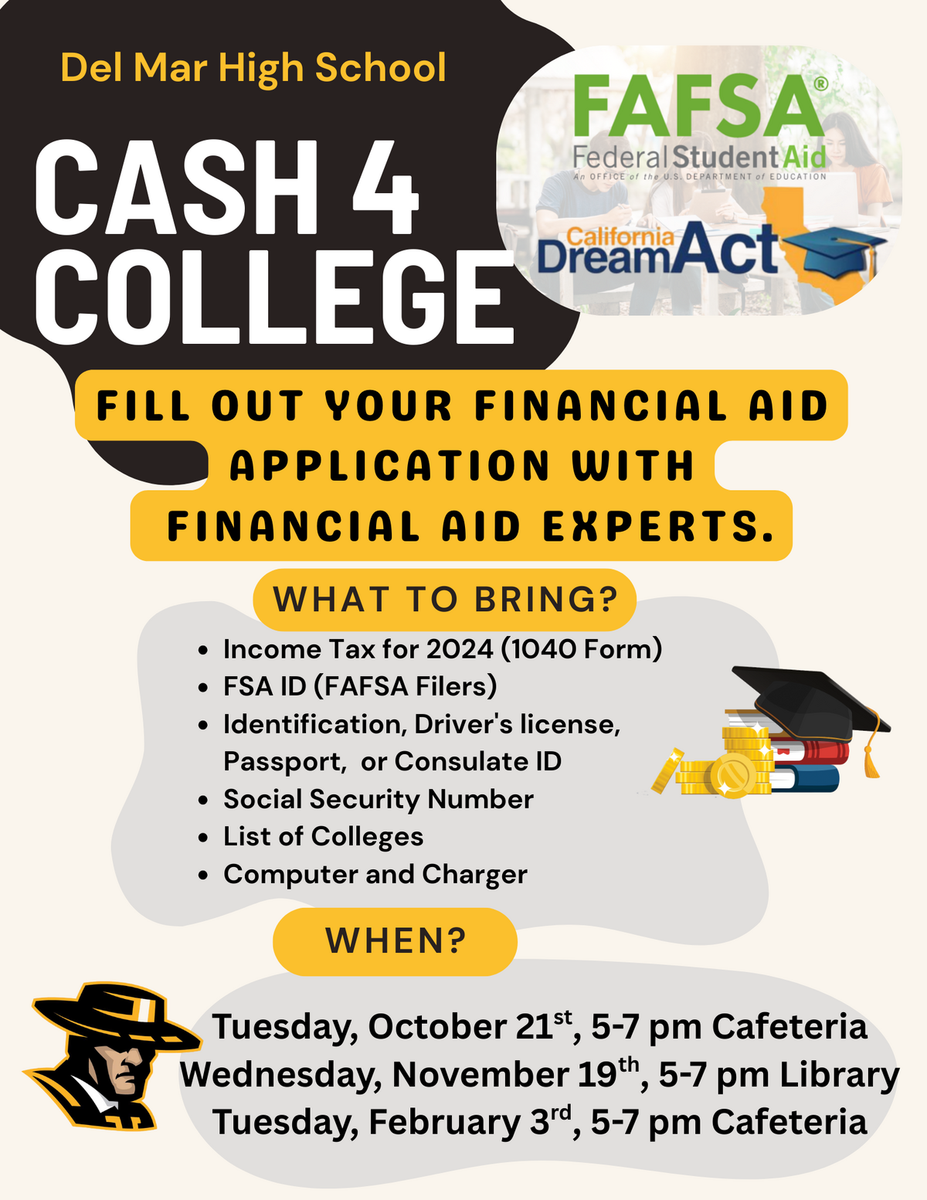

Save-the-Date for Cash for College Nights!1) Wednesday, November 19, 2025 - 5 to 7pm - Cafeteria

2) Tuesday, February 3, 2026 - 5 to 7pm - Cafeteria

Interested Senior Families may drop in to receive support with Financial Aid applications. Help will be available in English and Spanish. This is event is open to all graduating students who will be completing a financial aid application (FAFSA/CADAA) and offers support from College Financial Aid Advisors and time to get all questions answered.

Until then, should you have any questions, please contact Ms. Cajero in the College and Career Center.

|

On this page, you will find information on the following topics:

- Understanding the Financial Aid Process and Scholarships

- Federal Student Aid & Grants at a Glance

- General Scholarship Information

- LGBTQ Students' Scholarship Websites

- International Scholarship Websites

- General Scholarship Search Engines

- Free Application For Student Aid (FAFSA) - Information and Video

- California Dream Act - Information and Video

- Western Undergraduate Exchange (WUE) Program Information and Brochure

Understanding Financial Aid & Scholarships |

Choosing how to pay for college or vocational school is one of the first major financial decisions you will make as a young adult because it is likely the most expensive thing you have had to pay for at this stage of life. This is why it requires significant planning and support from family. Remember - every student can attend college and there is financial help available to you!

When talking with your family about the costs of college, consider the five main categories of college expenses:

- Tuition fees: the price colleges charge for classes, usually based on number of units you are taking.

- Room and board: housing, on or off campus, food and utilities.

- Course costs: books, supplies, equipment, etc.

- Personal expenses: laundry, cell phone bill, dining out, clothing, etc.

- Transportation costs: gas for driving to campus or visiting home, vehicle maintenance like oil changes, on-campus parking, or public transportation.

College costs vary depending on what college you go to and how much financial aid you receive. Although the average college tuition ranges from $3,440 - $32,410 depending on the type of school you select, the amount you pay may be much lower due to grants, scholarships, and other federal student aid awarded to you.

To learn more about Financial Aid, if you qualify, and how to apply, please review the document* below. You may also download this resource, at: studentaid.gov/sites/default/files/do-you-need-money.pdf.

Financial Aid Process

There are multiple ways to apply for financial aid. Please note this information is subject to change. For the most current information, please visit the specific application websites below.

Note: All documents and presentations offered above are for reference and informational purposes.

Free Application for Federal Student Aid (FAFSA) |

California Dream Act (CADAA) |

Financial aid refers to scholarships, grants, work-study, and loans that help students pay for college. Undocumented students who qualify under Assembly Bill (AB) 540 criteria can apply for financial aid by submitting the California Development, Relief, and Education for Alien Minors (Dream) Act Application. As a state law, the California Dream Act is separate from the federal Deferred Action for Childhood Arrivals (DACA) program. Undocumented students in California can still apply for financial aid without DACA status.

Please note: if you qualify under AB 540, you must complete the California Dream Act application as soon as possible or before March 2nd of your senior year of high school. Learn more ...

General Scholarship Information* |

A scholarship is money awarded to a student to help pay for his/her college education expenses. Scholarships, like grants, are monetary gifts that do not need to be repaid. Where grants are monetary gifts from public sources (from federal and state governments,) scholarships generally come from private sources.

There are a wide variety of scholarships offered in varying amounts and for various purposes. For example, a scholarship may cover the entire cost of your tuition or it might be a one-time award of a few hundred dollars. Either way, scholarships are worth applying for because they can help reduce the cost of your education. Use the websites below to search for scholarships.

Feel free to review some financial aid and scholarship information in this article: https://www.madisontrust.com/client-resources/articles/money-for-college-guide-to-scholarships-and-financial-aid/.

LGBTQ Student Scholarship Websites* |

- Scholarship Search: www.scholarships.com/financial-aid/college-scholarships/scholarships-by-type/scholarships-for-gay-or-lesbian-students/

- Human Rights Campaign: www.hrc.org/resources/scholarships

- Unigo Scholarships: www.unigo.com/scholarships/by-type/lgbt-scholarships

- College Scholarships: www.collegescholarships.org/scholarships/lgbt-students.htm

- Best Colleges Scholarships: www.bestcolleges.com/financial-aid/lgbtq-scholarships/

- FinAid Scholarships: finaid.org/otheraid/lgbt/

International Scholarship Websites* |

- International Scholarships and Financial Aid to Study Abroad: www.internationalscholarships.com/

- Study Abroad Scholarships and Grants in 2021: www.gooverseas.com/blog/study-abroad-scholarships-grants

General Scholarship Search Engines |

| Federal Student Aid Scholarship Search | studentaid.gov/understand-aid/types/scholarships |

| Naviance College Organizer | student.naviance.com/delmar |

| Fastweb Scholarship Search | www.fastweb.com/ |

| Unigo Scholarship Finder | www.unigo.com/ |

| College Board Scholarship Search | bigfuture.collegeboard.org/scholarship-search |

| Peterson's Scholarship Search | www.petersons.com/scholarship-search.aspx |

| Sallie Mae College Scholarships | www.salliemae.com/college-planning/college-scholarships/ |

|

Common Knowledge

Scholarship Foundation

|

www.cksf.org/ |

|

Scholly Scholarship Finder

Mobile App (at a fee)

|

myscholly.com/ |

WUE - Western Undergraduate Exchange |

WUE is the Western Undergraduate Exchange, a program coordinated by the Western Interstate Commission for Higher Education (WICHE). Through WUE, students in Western states may enroll in participating two-year and four-year public college programs at a reduced tuition level - up to 150% of the institution’s regular resident tuition. WUE tuition is considerably less than nonresident tuition. (Source: wiche.edu/wue.)